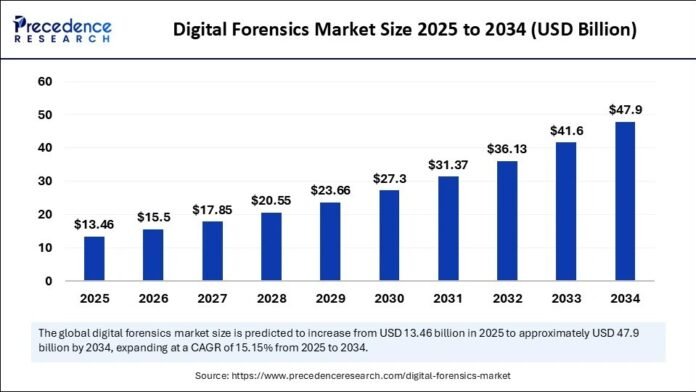

Digital Forensics Market Size and Forecast 2025 to 2034

The global digital forensics market is on a remarkable growth trajectory, with its size projected to expand from USD 13.46 billion in 2025 to approximately USD 47.9 billion by 2034. This growth represents a compound annual growth rate (CAGR) of 15.15% from 2025 to 2034. The market’s expansion is largely driven by the increasing digital transformation across industries and the urgent need for robust brand protection mechanisms. These factors are fostering transparent incident responses and enabling quicker financial fraud detection, thereby propelling the market forward.

Key Takeaways

- The digital forensics market was valued at USD 11.69 billion in 2024.

- It is projected to reach USD 47.9 billion by 2034.

- The market is expected to grow at a CAGR of 15.15% from 2025 to 2034.

- North America held the largest market share of 37% in 2024.

- The Asia Pacific region is anticipated to grow at the fastest CAGR in the upcoming years.

- The hardware segment accounted for the largest market share of 43% in 2024.

- The service segment is expected to grow at the highest CAGR between 2025 and 2034.

- Computer forensics captured the major market share in 2024, while cloud forensics is expected to grow significantly in the coming years.

- Forensic data analysis tools dominated the market in 2024, with forensic decryption tools expected to see rapid growth.

How is AI Revolutionizing the Digital Forensics Market?

Artificial intelligence (AI) is fundamentally transforming the digital forensics landscape. By automating evidence collection and accelerating data analysis, AI enhances the accuracy of threat detection. AI algorithms can swiftly analyze vast amounts of unstructured data, identifying behavioral patterns and anomalies that would take human analysts weeks to uncover. This capability not only expedites criminal investigations but also supports early intervention.

Traditional forensic products often require significant time and effort. However, AI simplifies log analysis, keyword searches, and image recognition, allowing investigators to focus on complex insights rather than administrative tasks. Machine learning models further reduce the risk of human error in evidence authentication, ensuring that digital evidence remains tamper-proof and admissible in court.

U.S. Digital Forensics Market Size and Growth 2025 to 2034

The U.S. digital forensics market was valued at USD 3.24 billion in 2024 and is projected to reach approximately USD 13.56 billion by 2034, growing at a CAGR of 15.39% from 2025 to 2034.

What Made North America the Dominant Region in the Digital Forensics Market?

North America leads the digital forensics market primarily due to the rising frequency of cyberattacks. The region’s technological maturity, sophisticated cyber infrastructure, and robust legal frameworks create an environment conducive to digital forensic innovation and adoption. The escalation of corporate data breaches and organized cyberattacks has prompted significant investments in digital investigation tools.

Laws such as HIPAA, SOX, and the USA PATRIOT Act require organizations to retain digital evidence and implement forensic mechanisms for regulatory compliance. The presence of major technology and cybersecurity firms in the U.S. and Canada, such as Magnet Forensics and Cellebrite, further fuels research and development in cutting-edge forensic tools.

Asia-Pacific Digital Forensics Market Trends

The Asia Pacific region is expected to experience the fastest growth during the forecast period, driven by rapid digital transformation and an increase in cyber threats. Government-backed cyber initiatives in emerging economies are also contributing to this growth. The adoption of cloud services, 5G technology, and fintech solutions is creating new opportunities for the digital forensics market.

National cyber missions, such as India’s Cyber Surakshit Bharat and China’s Cybersecurity Law, have led to significant investments in forensic tools. Additionally, the expansion of smart city projects and IoT deployments necessitates forensic technology to manage digital evidence from interconnected devices.

European Digital Forensics Market Trends

Europe is witnessing significant growth in the digital forensics market, driven by data privacy concerns and stringent regulations like the General Data Protection Regulation (GDPR). The GDPR mandates swift breach reporting and forensic evidence collection, making forensic tools essential for compliance.

The rise in cyber-espionage and ransomware attacks targeting critical infrastructure in Europe has increased the demand for sophisticated digital forensics tools. Investments in cloud infrastructure across Germany, France, and the Nordics are accompanied by a growing need for forensic solutions to secure these platforms.

Market Overview

Digital forensics applications span various industries, including law enforcement, defense, banking, healthcare, and private enterprises. The demand for digital forensics is fueled by the rise in cybercrime incidents and the legal necessity to preserve and present digital evidence. As technology continues to evolve, the digital forensics market must stay ahead of emerging threats and challenges.

Key Market Trends

- Volume and Velocity of Cybercrime: As cybercriminals become more resourceful, organizations must invest in agile forensic tools.

- Digital Transformation and Remote Work: The rise of cloud services and remote work has added complexity to investigations.

- Legislative Push: Laws like GDPR and HIPAA compel organizations to maintain forensic capabilities for compliance.

- Reputation Risk: Companies view forensics as a brand protection mechanism, ensuring transparent incident responses.

Market Dynamics

Drivers

The exponential rise in cybercrime, including ransomware attacks and data breaches, is a primary driver of the digital forensics market. As organizations become more vulnerable, the demand for robust investigative capabilities grows. The complexity of attacks has evolved, necessitating advanced forensic tools to trace digital footprints and preserve evidence.

Restraints

Data privacy concerns pose significant challenges for the digital forensics market. As forensic technologies delve deeper into personal devices and cloud accounts, issues surrounding civil liberties and data misuse arise. Laws like GDPR impose strict regulations on data access, limiting forensic teams’ capabilities.

Opportunities

The emergence of cloud forensics presents a significant opportunity for growth. As businesses migrate to cloud environments, the need for scalable forensic tools that can monitor SaaS, LaaS, and PaaS platforms becomes critical. The integration of AI into forensic tools will further enhance their effectiveness.

Component Insights

The hardware segment dominated the digital forensics market in 2024, as it plays a crucial role in capturing and preserving digital evidence. The increasing complexity of devices necessitates dedicated forensic equipment, driving demand for hardware solutions.

Conversely, the service segment is expected to grow at the highest CAGR, driven by the rising demand for outsourced forensic expertise and managed investigation services.

Type Insights

Computer forensics remains the dominant segment due to its central role in data processing and storage. However, cloud forensics is expected to see significant growth as organizations increasingly adopt cloud-based solutions.

Tool Insights

Forensic data analysis tools captured the maximum market share in 2024, driven by the need for accurate data analysis. Meanwhile, forensic decryption tools are expected to grow rapidly due to the increasing use of encrypted communications.

End-User Insights

The government and defense segment dominated the market in 2024, driven by increased investments in digital forensics tools. The healthcare sector is expected to grow at the fastest rate, as it faces heightened risks from cyberattacks.

Digital Forensics Market Companies

Recent developments in the digital forensics market include the release of new tools and standards aimed at enhancing forensic capabilities. For instance, in June 2025, the Institute of Chartered Accountants India proposed a comprehensive revision of forensic accounting standards. In July 2024, Exterro launched FTK 8.1, a digital investigations solution designed for speed and reliability.

Segments Covered in the Report

- By Component: Hardware, Software, Service

- By Type: Computer Forensics, Network Forensics, Mobile Device Forensics, Cloud Forensics

- By Tool: Data Acquisition & Preservation, Forensic Data Analysis, Data Recovery, Review & Reporting, Forensic Decryption

- By End Use: Government and Defense, Law Enforcement, Banking, Financial Services, and Insurance (BFSI), IT & Telecom, Retail, Healthcare

- By Region: North America, Asia Pacific, Europe, Latin America, MEA

In conclusion, the digital forensics market is poised for significant growth in the coming years, driven by the increasing complexity of cyber threats and the need for robust investigative capabilities. As technology continues to evolve, the market must adapt to meet the challenges of a rapidly changing digital landscape.