Report Overview

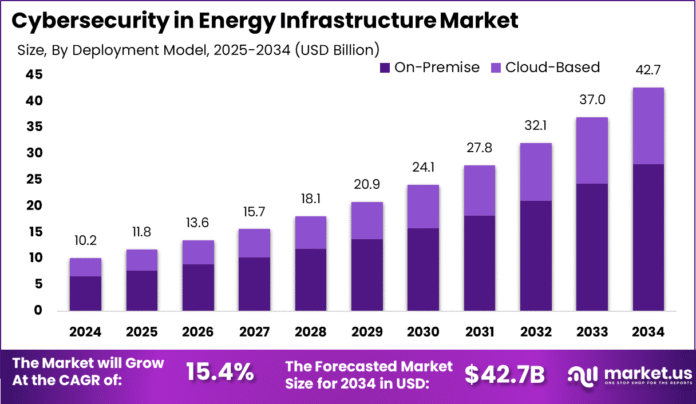

The Global Cybersecurity in Energy Infrastructure Market is poised for remarkable growth, projected to reach approximately USD 42.7 billion by 2034, up from USD 10.2 billion in 2024. This growth represents a robust compound annual growth rate (CAGR) of 15.4% during the forecast period from 2025 to 2034. In 2024, North America dominated the market, capturing over 35.5% of the share and generating USD 3.6 billion in revenue.

Cybersecurity in energy infrastructure involves the strategies and technologies designed to protect critical energy systems from cyber threats. These systems include power grids, oil and gas pipelines, and renewable energy installations, all of which are increasingly digitized and interconnected. The integration of advanced technologies, such as smart grids and Internet of Things (IoT) devices, has enhanced operational efficiency but also introduced new vulnerabilities.

Market Drivers

The cybersecurity market for energy infrastructure is experiencing substantial growth, primarily driven by the escalating frequency and sophistication of cyber threats. The rapid adoption of digital technologies, including smart grids and IoT devices, has expanded the attack surface for potential cyber threats.

Regions undergoing significant energy infrastructure modernization, particularly developing economies investing in smart grid technologies, are witnessing a surge in demand for robust cybersecurity frameworks. The increasing frequency of cyber incidents has heightened awareness among stakeholders, prompting them to fortify their systems against potential breaches.

The primary motivations for adopting cybersecurity measures in energy infrastructure include the need to protect critical assets, ensure uninterrupted energy supply, and comply with regulatory standards. Cybersecurity investments are also driven by the potential financial and reputational losses associated with cyber incidents. By implementing robust security protocols, energy companies aim to enhance operational resilience and maintain stakeholder trust.

According to research from Cyber Magazine, 42% of critical infrastructure organizations, including those in the energy sector, experienced cyber breaches in 2024. Alarmingly, 93% of these firms reported a noticeable rise in cyberattacks, making cybersecurity a frontline concern.

Human error remains a significant driver of breaches, accounting for 34% of cloud-based incidents, followed closely by the exploitation of known vulnerabilities (31%) and weak multi-factor authentication practices (20%). Additionally, 30% of critical infrastructure companies encountered insider threat incidents, highlighting urgent gaps in access control and employee awareness.

Key Takeaways

- The global cybersecurity in energy infrastructure market is forecasted to reach USD 42.7 billion by 2034, rising from USD 10.2 billion in 2024, supported by a CAGR of 15.4% during 2025-2034.

- North America led the market in 2024 with a 35.5% share, generating USD 3.6 billion in revenue, primarily driven by rising threats to energy grids and stricter regulatory mandates.

- The U.S. market alone contributed USD 2.9 billion in 2024 and is projected to reach USD 10.4 billion by 2034, expanding steadily at a 13.7% CAGR.

- Solution-based offerings dominated the landscape, capturing 80.2% of the market share, driven by high demand for advanced intrusion detection, network monitoring, and encryption tools.

- The on-premise deployment model held a significant 65.7% share in 2024, as critical energy operators prefer in-house control over sensitive infrastructure data.

- Large enterprises accounted for 75.9% of the market, largely due to their vast asset networks and complex risk environments.

- The industrial end-user segment led with a 40.3% share, as oil & gas, nuclear, and grid operators are becoming prime targets for cyberattacks, prompting aggressive security upgrades.

Analysts’ Viewpoint

The growing emphasis on cybersecurity presents lucrative investment opportunities in the energy sector. Companies specializing in cybersecurity solutions are well-positioned for growth as energy providers seek to upgrade their security infrastructure. Investments in research and development of innovative security technologies, along with workforce training and development, are critical areas with significant potential for returns.

The regulatory landscape for cybersecurity in energy infrastructure is becoming increasingly stringent. Governments and regulatory bodies worldwide are introducing policies and standards to ensure the protection of critical energy systems. For instance, the North American Electric Reliability Corporation (NERC) has established Critical Infrastructure Protection (CIP) standards that mandate specific cybersecurity measures for energy providers.

US Market Expansion

The U.S. Cybersecurity in Energy Infrastructure Market is valued at approximately USD 2.9 billion in 2024 and is predicted to increase from USD 5.5 billion in 2029 to approximately USD 10.4 billion by 2034, projected at a CAGR of 13.7% from 2025 to 2034.

North America Growth

In 2024, North America held a dominant market position in the cybersecurity for energy infrastructure sector, capturing over 35.5% of the global market share and generating approximately USD 3.6 billion in revenue. This leadership is primarily attributed to the region’s advanced energy infrastructure, stringent regulatory frameworks, and heightened awareness of cyber threats targeting critical systems.

The United States has witnessed a significant surge in cyberattacks on utilities, with incidents increasing by 70% compared to the previous year. Such alarming trends have propelled substantial investments in robust cybersecurity measures to safeguard the energy sector. The region’s proactive approach is further reinforced by regulatory mandates like the NERC CIP standards, which compel energy providers to implement comprehensive security protocols.

Component Insights

In 2024, the Solution segment held a dominant market position in the cybersecurity for energy infrastructure market, capturing more than 80.2% of the share. This significant lead can be attributed to the escalating need for robust security measures to protect critical energy systems from sophisticated cyber threats.

As energy infrastructures become increasingly digitized, the demand for comprehensive solutions—encompassing network security, endpoint protection, application security, and data safeguarding—has surged. These solutions are essential in mitigating risks associated with the integration of smart grids, IoT devices, and cloud-based operations within the energy sector.

The prominence of the Solution segment is further reinforced by the sector’s proactive approach to adopting advanced technologies such as artificial intelligence and machine learning for threat detection and response. The implementation of these technologies enables real-time monitoring and swift mitigation of potential cyber incidents, thereby enhancing the resilience of energy infrastructures.

Deployment Model Insights

In 2024, the On-Premise deployment model held a dominant position in the cybersecurity for energy infrastructure market, capturing more than 65.7% of the share. This preference is largely attributed to the energy sector’s stringent requirements for data sovereignty, regulatory compliance, and direct control over critical systems.

Energy companies often manage sensitive operational technologies (OT) and industrial control systems (ICS) that demand high security and minimal latency. On-premise solutions provide the necessary control and customization to meet these specific needs, ensuring that cybersecurity measures are closely aligned with the unique operational requirements of energy infrastructure.

Enterprise Size Insights

In 2024, the Large Enterprises segment held a dominant position in the cybersecurity market for energy infrastructure, capturing more than 75.9% of the share. This dominance is primarily due to the complex and expansive nature of large enterprises, which operate extensive energy infrastructures that are often spread across multiple regions and jurisdictions.

Such vast operations necessitate comprehensive cybersecurity measures to protect against sophisticated cyber threats that could disrupt critical energy services. Large enterprises have the financial and technical resources to invest in advanced cybersecurity solutions, ensuring the resilience and reliability of their energy infrastructure.

End User Insights

In 2024, the Industrial segment held a dominant position in the cybersecurity market for energy infrastructure, capturing more than 40.3% of the share. This leadership is primarily attributed to the increasing digitization and automation within industrial operations, which, while enhancing efficiency, also expose critical systems to sophisticated cyber threats.

Industrial facilities, including manufacturing plants and processing units, rely heavily on Operational Technology (OT) systems such as Supervisory Control and Data Acquisition (SCADA) and Distributed Control Systems (DCS). The integration of these systems with Information Technology (IT) networks has expanded the attack surface, making them prime targets for cyberattacks.

Key Market Segments

By Component

-

Solution

- Network Security

- Endpoint Security

- Application Security

- Data Security

- Others

- Services

- Vulnerability Assessment

- Digital Risk and Threat Monitoring

- Business Continuity Services

- Disaster Recovery

- Others

By Deployment Model

- On-Premise

- Cloud-Based

By Enterprise Size

- Small and Medium-sized Enterprises (SME)

- Large Enterprises

By End User

- Industrial

- Power Plants

- Commercial

- Residential

Emerging Trends

The energy sector is witnessing a surge in sophisticated cyber threats, driven by the integration of digital technologies and the increasing complexity of supply chains. Notably, the rise of Ransomware-as-a-Service (RaaS) has lowered the barrier for cybercriminals, enabling them to launch targeted attacks with minimal technical expertise.

These attacks often exploit vulnerabilities in third-party vendors, emphasizing the need for comprehensive supply chain risk management. Additionally, the adoption of Zero Trust Architecture is gaining traction, promoting continuous verification of user identities and limiting access to critical systems.

Artificial Intelligence (AI) and Machine Learning (ML) are becoming double-edged swords in the cybersecurity landscape. While they offer enhanced threat detection capabilities, adversaries are also leveraging these technologies to automate attacks and craft more convincing phishing campaigns.

Business Benefits

Investing in robust cybersecurity measures offers significant business advantages for energy companies. Firstly, it ensures operational continuity by protecting critical infrastructure from disruptions caused by cyberattacks. Enhanced cybersecurity fosters compliance with regulatory requirements, mitigating the risk of legal penalties and fines.

A strong cybersecurity posture enables the safe integration of innovative technologies, such as smart grids and renewable energy solutions, driving efficiency and sustainability. Ultimately, prioritizing cybersecurity not only protects assets but also supports long-term business growth and resilience.

Driver: Regulatory Mandates

The energy sector is experiencing a significant push towards enhanced cybersecurity, primarily driven by evolving regulatory requirements. Governments and regulatory bodies are implementing stringent cybersecurity standards to protect critical infrastructure from increasing cyber threats.

For instance, the U.S. government’s cybersecurity implementation plan outlines high-impact initiatives aimed at securing the energy ecosystem, emphasizing the integration of secure-by-design principles throughout the product life cycle.

Restraint: High Costs of Cybersecurity Implementation

Despite the recognized importance of cybersecurity, the high costs associated with implementing comprehensive security measures pose a significant restraint for energy companies. The financial burden includes expenses related to upgrading legacy systems, deploying advanced security technologies, and hiring skilled cybersecurity professionals.

A survey revealed that the median recovery costs for critical infrastructure sectors like energy have quadrupled to $3 million over the past year, highlighting the substantial financial impact of cyber incidents.

Opportunity: Leveraging AI for Enhanced Security

The integration of Artificial Intelligence (AI) presents a promising opportunity to bolster cybersecurity in the energy sector. AI technologies can enhance threat detection capabilities, automate response mechanisms, and predict potential vulnerabilities, thereby improving the overall security posture.

Research indicates that implementing AI solutions in energy infrastructure has led to a 98% improvement in threat detection rates and a more than 70% reduction in response times to cyber incidents.

Challenge: Securing Legacy Systems

A significant challenge in the energy sector’s cybersecurity efforts is the prevalence of legacy systems that were not designed to withstand modern cyber threats. These outdated systems often lack the necessary security features and are difficult to integrate with contemporary cybersecurity solutions.

Addressing this challenge requires substantial investments in system upgrades or replacements, which can be financially and operationally taxing. Moreover, the process of modernizing legacy systems must be carefully managed to avoid disruptions in energy supply.

Key Player Analysis

Eaton Corporation plc has strategically expanded its cybersecurity capabilities through key acquisitions. In 2024, Eaton acquired Exertherm, enhancing its thermal monitoring solutions for critical infrastructure. Siemens has reinforced its position in industrial cybersecurity through strategic acquisitions and partnerships, including the acquisition of Altair Engineering Inc.

AT&T has restructured its cybersecurity operations to better serve the energy sector, launching LevelBlue, a standalone managed cybersecurity services business aimed at providing scalable solutions for critical infrastructure protection.

Top Key Players Covered

- Eaton Corporation plc

- Siemens

- AT&T

- Schweitzer Engineering Laboratories, Inc.

- Accenture

- ABB

- Schneider Electric

- General Electric

- Hitachi Energy Ltd.

- IBM Corporation

Recent Developments

In April 2025, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) disclosed hardware vulnerabilities in Hitachi Energy’s RTU500 series, which could allow attackers to cause denial-of-service conditions. In February 2024, GE Vernova’s Grid Solutions business partnered with Dragos Inc. to offer comprehensive industrial cybersecurity solutions aimed at enhancing the resilience of the electric grid.

Conclusion

The cybersecurity landscape in energy infrastructure is evolving rapidly, driven by increasing cyber threats and regulatory pressures. As the market grows, energy companies must prioritize robust cybersecurity measures to protect their critical assets and ensure operational continuity. The integration of advanced technologies, such as AI and machine learning, alongside strategic investments in cybersecurity solutions, will be crucial for navigating the complexities of the modern threat landscape.